Reliance Industries Q1 FY26 Results: A Deep Dive into Record Profits and Strategic Shifts

Introduction

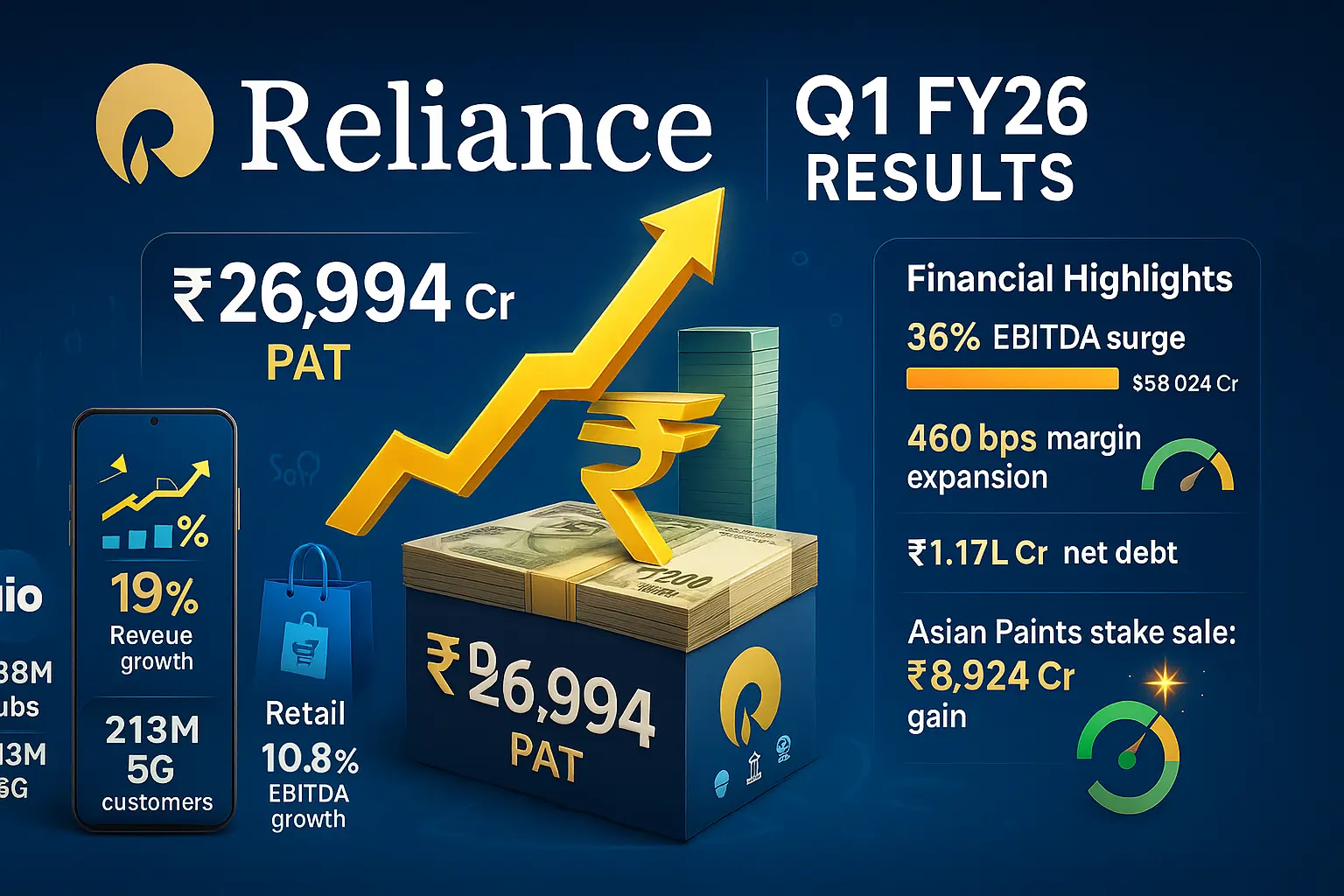

Reliance Industries Limited (RIL) has once again demonstrated its financial resilience and business agility with its Q1 FY26 (April-June 2025) results, posting a 78% YoY surge in net profit to ₹26,994 crore. This stellar performance was driven by a mix of strategic monetization (Asian Paints stake sale), robust consumer business growth (Jio & Retail), and operational efficiency improvements.

In this detailed analysis, we break down RIL’s Q1 FY26 earnings, segment-wise performance, management outlook, and what investors should watch in the coming quarters.

Key Financial Highlights

1. Record Profitability

- Net Profit (PAT) at ₹26,994 crore (+78% YoY, +39% QoQ)

- Includes one-time gain of ₹8,924 crore from the sale of its 4.9% stake in Asian Paints.

- Underlying PAT (ex-one-time gain) at ₹18,070 crore (+19% YoY).

- EBITDA at ₹58,024 crore (+36% YoY, +19% QoQ)

- Margins expanded 460 bps YoY to 21.2%, reflecting cost optimization.

2. Revenue Growth – Steady but Mixed

- Gross Revenue at ₹2.73 lakh crore (+6% YoY).

- Operating Revenue at ₹2.49 lakh crore (+5.3% YoY).

- Jio & Retail drove growth, while O2C & Oil & Gas saw muted performance.

3. Debt & Capex Update

- Net Debt at ₹1.17 lakh crore (vs. ₹1.12 lakh crore in Q1 FY25).

- Capex Spend: ₹32,000 crore in Q1 (focus on 5G, retail expansion, and green energy).

Segment-Wise Performance Breakdown

1. Jio Platforms – The Digital Powerhouse

- Subscriber Base: 498 million (+9.9 million in Q1).

- 5G Penetration: 213 million users (43% of total subs).

- Financials:

- Revenue: ₹41,054 crore (+19% YoY).

- EBITDA: ₹18,135 crore (+24% YoY).

- ARPU at ₹208.8 (+15% YoY, +1.2% QoQ).

- Key Developments:

- JioAirFiber now the world’s largest FWA service (7.4 million subs).

- JioGames Cloud launched with 500+ titles.

- Jio Bharat 5G phone shipments crossed 5 million units.

2. Reliance Retail – Omnichannel Dominance

- Revenue: ₹84,171 crore (+11% YoY).

- EBITDA: ₹6,381 crore (+13% YoY).

- Store Expansion: 19,592 stores (+388 in Q1).

- Customer Base: 358 million (+42 million YoY).

- Strategic Moves:

- Acquired Kelvinator (appliance brand) to strengthen consumer durables.

- JioMart daily orders surged 175% YoY.

- FMCG Spin-off: Reliance Consumer Products demerged to focus on branded goods.

3. Oil-to-Chemicals (O2C) – Margins Improve Despite Revenue Dip

- Revenue: ₹1.55 lakh crore (-1.5% YoY).

- EBITDA: ₹14,511 crore (+10.8% YoY).

- Key Factors:

- Lower crude prices & planned maintenance shutdowns impacted revenue.

- Stronger domestic fuel margins (via Jio-bp network) lifted profitability.

4. Oil & Gas – Weakness Continues

- Revenue: ₹6,103 crore (-1.2% YoY).

- EBITDA: ₹4,996 crore (-4.1% YoY).

- Reason: Lower production from KG-D6 basin.

5. New Energy & Other Businesses

- Green Energy:

- On track to commission giga-factories in 4-6 quarters.

- Targeting 55 CBG (compressed biogas) plants by 2025-end.

- JioStar (Media):

- IPL 2025 drove record revenue (₹11,222 crore).

- Peak concurrency: 55.2 million viewers.

Management Commentary & Strategic Outlook

1. Mukesh Ambani’s Vision

- “Our consumer businesses (Jio & Retail) are now the primary growth engines.”

- Target: Doubling business value every 4-5 years.

- Focus Areas: AI, 5G monetization, and retail scalability.

2. Isha Ambani on Retail Expansion

- “Kelvinator acquisition strengthens our presence in premium appliances.”

- Omnichannel strategy: Integrating JioMart with offline stores.

3. Akash Ambani on Jio’s 5G & AI Push

- “5G adoption is accelerating; we’re investing in AI-driven services.”

- Jio’s AI cloud infrastructure to launch by Q3 FY26.

Market Reaction & Investor Takeaways

1. Stock Performance

- RIL shares up 22% YTD (2025).

- Market cap added $40 billion since Jan 2025.

2. Valuation & Risks

- Forward P/E: 14.2x (vs. 5-yr avg of 18x).

- Key Risks:

- Refining margin volatility.

- Rising competition in retail & telecom.

3. What’s Next for RIL?

- Jio’s IPO expected in FY27 (valuation ~$120 billion).

- Retail IPO likely post-FY26.

- Green energy monetization by 2026.

Conclusion: A Strong Start to FY26

Reliance Industries has delivered a strong Q1 FY26, with Jio and Retail leading growth, while O2C remains stable. The Asian Paints stake sale provided a one-time boost, but underlying profitability remains robust.

Investors should watch:

✅ Jio’s 5G monetization & AI push

✅ Retail’s expansion & FMCG spin-off

✅ New energy project execution

For more details, visit RIL’s Investor Relations.

Data Source: RIL Q1 FY26 Earnings Release, Analyst Calls

Disclaimer: This is not investment advice. Please consult a financial advisor before making decisions.