Introduction

Bajaj Finance, India’s largest non-banking financial company (NBFC), reported strong Q1 FY26 (April–June 2025) results, with 22% YoY growth in net profit and 25% expansion in assets under management (AUM). However, rising non-performing assets (NPAs) and elevated credit costs raised concerns about asset quality.

This detailed analysis covers:

✅ Key financial highlights

✅ Loan growth & customer acquisition trends

✅ Asset quality & provisioning risks

✅ Management commentary & future outlook

✅ Market reaction & investor takeaways

Key Financial Highlights

1. Profitability & Income Growth

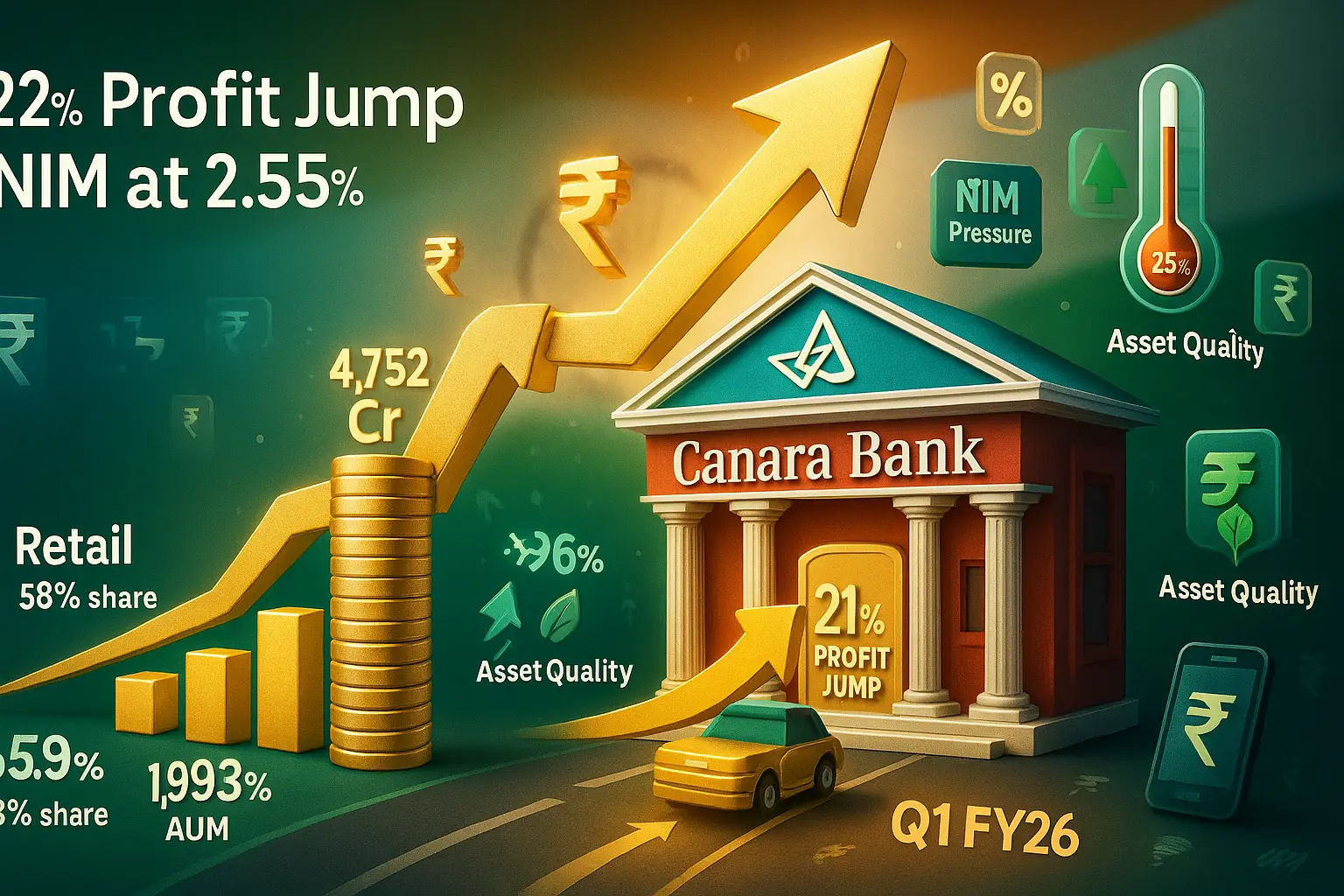

- Net Profit (PAT): ₹4,765 crore (+22% YoY)

- Net Interest Income (NII): ₹10,227 crore (+22% YoY)

- Total Income: ₹16,697 crore (+21.6% YoY)

2. Loan & Customer Growth

- Assets Under Management (AUM): ₹4.41 lakh crore (+25% YoY)

- New Loans Booked: 13.49 million (+23% YoY)

- Customer Base: 106.51 million (+21% YoY)

3. Asset Quality Deterioration

- Gross NPA: 1.03% (vs. 0.86% in Q1 FY25)

- Net NPA: 0.50% (vs. 0.38% in Q1 FY25)

- Provisions: ₹2,120 crore (+26% YoY)

Segment-Wise Performance Breakdown

1. Core Business (Standalone)

- AUM: ₹3.25 lakh crore (+24% YoY)

- NII: ₹9,269 crore (+21% YoY)

- Gross NPA: 1.28% (worse than consolidated)

2. Subsidiaries

- Bajaj Housing Finance (BHFL):

- AUM: ₹1.20 lakh crore (+24% YoY)

- Net Profit: ₹583 crore (+21% YoY)

- Strong asset quality (GNPA: 0.30%)

- Bajaj Financial Securities (BFinsec):

- Net Profit: ₹41 crore (+37% YoY)

Management Commentary & Future Outlook

1. Leadership Stability

- Rajeev Jain (Vice Chairperson) confirmed he will remain in an operational role until March 2028 .

2. Credit Cost & NIM Guidance

- FY26 Credit Cost: Expected at 185–195 bps (elevated due to MSME & 2-wheeler loan stress) .

- Net Interest Margin (NIM): Likely flat with slight upside (5–10 bps) .

3. Growth Strategy

- FY26 AUM Growth Target: 23–24% .

- Focus Areas:

- Gold loans (adding ₹2,000 crore/quarter)

- SME & rural lending (despite stress signals) .

Market Reaction & Investor Takeaways

1. Stock Performance

- Pre-results: Fell 0.95% on July 24 .

- Post-results: Expected to trade volatile due to mixed signals (growth vs. NPAs).

2. Analyst Views

- Bullish: Strong AUM growth & customer addition .

- Cautious: Rising NPAs in unsecured/MSME loans .

3. Key Risks

⚠️ MSME Stress: 13 of 17 tracked sectors show slowdown .

⚠️ Consumer Leverage: Rising multi-loan customers .

Conclusion: Should You Invest?

Bajaj Finance delivered strong growth but faces asset quality challenges. Investors should:

✅ Monitor NPA trends in Q2 FY26.

✅ Watch for management’s execution on credit cost control.

✅ Consider long-term potential given leadership stability.

Disclaimer: Not investment advice. Consult a SEBI-registered advisor before investing.

What’s your view on Bajaj Finance’s Q1 results? Share in comments! 💬

SEO Optimization for Yoast

- Focus Keyword: “Bajaj Finance Q1 FY26 results”

- Meta Description: “Bajaj Finance Q1 FY26 net profit up 22% to ₹4,765 crore. AUM grows 25%, but NPAs rise. Full analysis on growth, risks & outlook.”

- URL Slug:

/bajaj-finance-q1-fy26-results-analysis - Image Alt Text: “Bajaj Finance Q1 FY26 performance highlights infographic”

Would you like a deeper dive into any specific segment (e.g., MSME stress or gold loan growth)? Let me know!